Candlestick patterns forex software

GET MY FAVORITE TRADE SETUP as my Gift To You by filling out the form on the right! Many people believe that high profit candlestick patterns are found by simply identifying the bars in the candle chart alone. However the truth is that while Japanese candlestick charting patterns are an excellent tool to use in your technical analysis, determining if they are high probability or not is dependent upon where they occur in the context of the chart. Finding a doji, shooting star, dark cloud cover or hanging man candlestick is not enough for a high probability and high profit trading signal whether you are trading the stock market, futures for the Forex market.

This brief video demonstrates the concept that high profit candlestick patternsby themselves, do not consistently produce reliable, profitable trading signals. This is a very basic video for those fairly new to candle charts.

Also, click here to receive one of my Favorite Trading Setupsand get my FREE 5-Day Video Trading Course. Much study has been devoted to Japanese candlestick charting techniques. Steve Nison originally made detailed analysis of these trading signals and traders ever since have benefited from some form of his work.

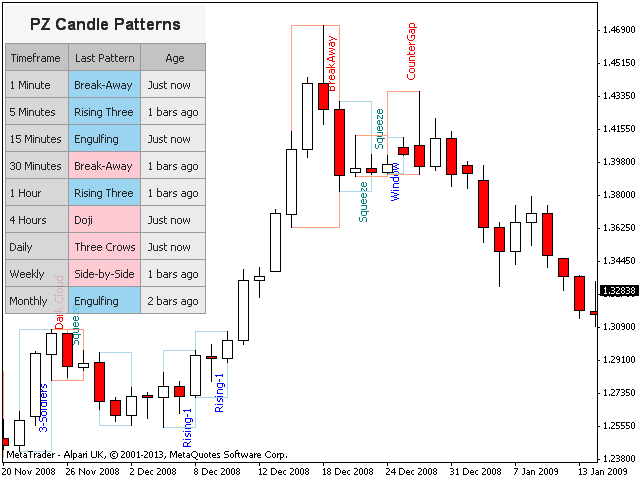

In trading software, a chart moves or updates according to the chosen time period and as the candle pattern reflects the ups and downs of the market, in time a trader can learn how to read candlestick charts. The market is driven by many things, most notably national and international news and economic forecasts. Traders react in certain ways and the chart patterns show up in the candle chart. As candles appear in relation to one another, they form patterns that show trends and thus help traders make decisions of when to enter and when to exit a trade.

In this way, traders get a feel for the market and can make educated determinations as to when to buy or sell. Buying and selling stocks, futures and the Forex market is a difficult business but experienced traders have managed to reduce a certain amount of the risk by using the Japanese candlestick charting techniques devised by Homma and brought to the West by Steve Nison. A Hammer candlestick may appear as the market is moving down, indicating a change trend and a possible bottom being put in place.

It has a short body with a long wick below the real body indicating a possible rejection of the prices below it.

The 5 Most Powerful Candlestick Patterns | Investopedia

If there are other indications confirming the candlestick pattern, a trader may then decide to enter a long position in the Forex market or buy stock, futures or options. On the other hand, the Hanging Man which is the same single candlestick jquery form radio selected value, but occurs while a market is moving up indicates the opposite — that the trend may change and start going down or bearish.

A Doji is a candle that has no body — the open and close were the same. Another popular candle pattern is the Spinning Top. Here the candle body is small and the wicks on both ends are longer than the body.

This pattern indicates uncertainty in the candlestick patterns forex software so the trader will likely wait. These are only a few of multitudes of candlestick types which play a part in how traders use Japanese candlestick charting patterns to help them make their trading decisions.

Candlestick techniques are just one aspect of technical analysis and so should not be used exclusively to make trading decisions. One must also consider support and resistance, the larger trend, cycles, momentum and other dual binary option pricing frames.

For a complete explanation of these other energies, please see the free video on this site. In the early s, a candlestick patterns forex software Japanese rice merchant, Munehisa Homma, developed a system of tracking data entry jobs from home toowoomba analyzing rice futures, which over time matured into the high profit candlestick patterns we know today.

Homma is credited for creating or developing stock trading courses in pune specialized Japanese free trial forex buy sell signal software review trading signals during the early history of the futures market.

Incredible Charts: Candlestick Chart Patterns

Until aboutactual rice was traded from hand to hand. The futures market was developed with the idea that traders gave coupons or a promise to deliver rice at some future date.

This quickly emerged as a very lucrative form of business so the futures market was born. His ability to analyze the rice futures using what is now called Japanese candlestick charting techniques revolutionized trading and as such made him possibly the wealthiest trader in market history.

Terms like Dark Cloud Cover, Doji Candlestick, Shooting Star, and Hanging Man Candlestick are bantered about in trading circles probably with little thought for their humble beginnings in the rice trade and the infant futures market. What we are left with is a powerful collection of stock trading glossary terms signals when we learn how to read candlestick charts for trading the futures, stock or Forex market.

A candle represents the high, low, open and close of a commodity, stock or currency for a certain period of time. Stocks, commodities and currencies can be traded in almost endless time frames such as 1, 5, 15 minute, 1 hour, 1 day, and 1 week time periods. For example on a one minute chart, one candle equates to how much the price moves on the market in one minute.

A bull candle, which is indicating increasing price, shows the opening price at the bottom of the body of the candle and the close price at the top of the body. Any extensions called shadows or the wick of the candle show the high and low price for that period. A bear candle shows the opposite of the bull or a decreasing price: The bullish Japanese candlestick pattern is usually color-coded green close above the open.

Forex Candlestick Patterns Explained With ExamplesThe bearish Japanese candlestick pattern is usually color-coded red close below open. You will receive one of my favorite setups for emini trading, forex day trading and stock market trading: You'll receive it on day 4 of my FREE 5-Day Video Mini-Course: To get the setup for "The Rubber Band Trade," your subscription to my newsletter, and the 5-Day Video Stock, Emini and Forex Training, simply fill out the form below. You'll instantly receive an email with the link to your first video lesson TODAY.

What's Your Biggest Question About Trading? Complete the " ASK BARRY FORM" and Receive a Prompt, Personal Response. In this class taught by Dr. Barry Burns he gives away the complete overview of his entire trading methodology. The class is a full ONE HOUR LONG and was recorded. TOP DOG TRADING COURSES. TOP DOG AFFILIATE PROGRAM.

The companies below are partners from which we have a monetary or non-monetary material connection except for "Save the Children". The performance indicated or implied by authors or users on this web site is not what you should expect to experience.

The company has not substantiated any of the comments or claims. Home Pages TRADING COURSES Trading Signals Video FREE Trade Setup About Me. High Profit Candlestick Patterns. ASK BARRY What's Your Biggest Question About Trading? FREE TRADING CLASS In this class taught by Dr. MORE TOP DOG TRADING RESOURCES FOR YOU TOP DOG TRADING COURSES FREE TRADING VIDEOS STUDENT RESULTS TOP DOG AFFILIATE PROGRAM.

Disclosure The companies below are partners from which we have a monetary or non-monetary material connection except for "Save the Children".

Privacy Policy Terms of Service Earnings Disclaimer Contact Us.

Important Notice The performance indicated or implied by authors or users on this web site is not what you should expect to experience.

Become my Facebook friend RSS Tweet with me. Suffusion theme by Sayontan Sinha.