Gold futures brokers

Attention Required! | Cloudflare

Gold Futures and Options - Perhaps no other market in the world has the universal appeal of gold. For centuries, it has been coveted for its unique blend of rarity, beauty, and near indestructibility.

Nations have embraced gold as a store of wealth and a medium of international exchange; individuals have sought to possess gold as insurance against the day-to-day uncertainties of paper money. Commercial concentrations of gold are found in widely distributed areas: Seawater contains astonishing quantities of gold, but its recovery is not economical.

Today, the world's unmined reserves are estimated at 1 billion troy ounces, with about half located in the Witwatersrand area of South Africa.

The Commonwealth of Independent States, Canada, the United States, Brazil, and Australia are also major producers. Gold futures opened for trading in the United States on December 31, , timed to coincide with the lifting of a year ban on the private ownership of gold by U.

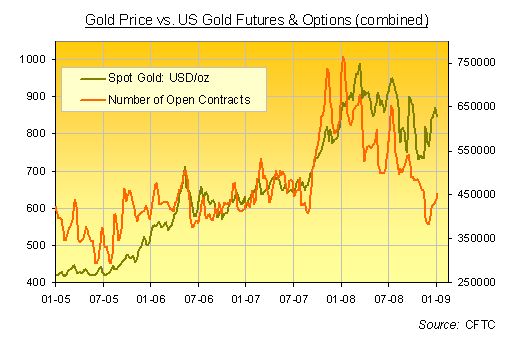

Today, gold prices float freely in accordance with supply and demand, responding quickly to political and economic events. The New York Mercantile Exchange merged with the Commodity Exchange, Inc. COMEX in August to become the world's largest physical commodity futures exchange.

Forex & Gold Futures Trading StrategiesTrading is conducted through two divisions; the NYMEX division, which trades a variety of energy futures, platinum futures and options platinum and palladium futures, and the COMEX division which trades gold, silver and copper futures and options. As the dominant exchange for futures and options trading in gold, silver, copper, and platinum; palladium futures; and energy futures and options, the Exchange's liquidity, price transparency, and financial integrity makes it a benchmark for these markets worldwide.

Gold's importance in world markets and responsiveness to world events make COMEX Division gold futures and options an important risk management tool for commercial interests as well as an exciting, potentially rewarding opportunity for those investors who seek to profit by correctly anticipating price changes.

Exchange-Based Gold Trading The New York Mercantile Exchange merged with the Commodity Exchange, Inc. Why Trade COMEX Division Gold Futures and Options?