How many companies on nasdaq composite

The NASDAQ Stock Market is an American stock exchange designed to enable investors to buy and sell stocks on an automatic, transparent and speedy computer network.

Also known simply as the NASDAQ, which originally stood for the National Association of Securities Dealers Automated Quotations, its creation offered an alternative to the in-person stock transaction system, which the NASD believed burdened investors with inefficient trading and delays. The NASDAQ now contains about 3, publicly traded companies, and is the second largest stock exchange in terms of its securities' values and the largest electronic stock market.

The NASDAQ trades shares in a variety of types of companies — including capital goods, consumer durables and non-durables, energy, finance, healthcare, public utilities, technology, and transportation — but it is most well-known for its high-tech stocks. To be listed on the NASDAQ National Market, companies must meet specific financial criteria. For smaller companies unable to meet the financial requirements, there is the NASDAQ Small Caps Market. NASDAQ will shift companies from market to market as eligibility changes.

Because it is an electronic exchange, the NASDAQ offers no trading floor.

Today's Stock Market News and Analysis - eqogypacuc.web.fc2.com

The exchange itself is a dealers' market, so brokers buy and sell stocks through a market maker rather than from each other directly. A market maker handles a specific stock and holds a certain amount of stock in his or her books. When a broker wants to purchase shares, he or she does it directly from the market maker.

When the NASDAQ first began, stock trading took place over a computer bulletin board system and over the telephone. Now, trading on the NASDAQ occurs using automated trading systems, which offer full reports on trades and on daily trading volumes.

NASDAQ vs NYSE - Difference and Comparison | Diffen

Automated trading also offers automatic execution of trades based on parameters set by the trader. This low fee enables the trading of many new, high growth, and volatile stocks.

While the New York Stock Exchange is still considered a bigger exchange because its market capitalization is much higher, the NASDAQ has a greater trading volume than any other U. With no trading floor, NASDAQ built the NASDAQ MarketSite in Manhattan's Times Square to create a tangible physical presence. The large outdoor electronic display gives current financial information on the tower 24 hours a day. Trading takes place Monday through Friday, 9: Eastern time, except for major holidays.

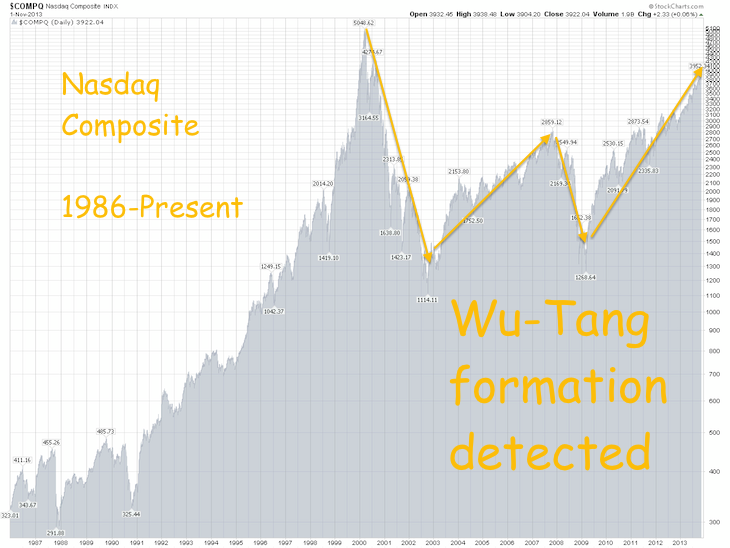

Like any stock exchange, the NASDAQ uses an index, or a collection of stocks that are used to deliver a market performance snapshot. The NYSE offers the Dow Jones Industrial Average DJIA as its primary index, and NASDAQ offers the NASDAQ Composite and the NASDAQ The NASDAQ Composite Index measures the change in more than 3, stocks traded on NASDAQ, whereas the DJIA measures the peaks and troughs of 30 big companies.

The NASDAQ Composite is often referred to as just "the NASDAQ" and is the index most often quoted by financial journalists and reporters. The NASDAQ is a modified capitalization-weighted index made up of the largest companies in market value that trade on the NASDAQ. These companies cover a range of market sectors, though the largest are generally technology-related. Companies can be added and removed each year from the NASDAQ depending on their market value.

Both the NASDAQ Composite and the NASDAQ include companies incorporated outside of the United States, as well as American companies. This differs from other major indexes, as the DJIA does not include foreign companies.

Founded by the National Association of Securities Dealers, the NASDAQ opened on Feb. The world's first electronic stock market began by trading more than 2, over-the-counter securities. At the time, the NASDAQ was a computer bulletin board-type system. At first, no actual trading took place between buyers and sellers.

Instead, the NASDAQ evened the traders' odds by narrowing the spread between the bid price and ask price of stocks. Thanks to its tech-heavy nature, the NASDAQ Composite took a major hit after the dot-com bubble burst of the late s, dropping from over 5, to below 1, Other notable dates on the NASDAQ timeline include:. AMEX was acquired by NYSE Euronext in and its data was integrated into the NYSE.

NASDAQ OMX buys the Boston Stock Exchange. Product and service reviews are conducted independently by our editorial team, but we sometimes make money when you click on links. Grow Your Business Finances. Hom, BusinessNewsDaily Contributor November 9, The NASDAQ's only physical presence is the MarketSite in Times Square in New York City. Makeup of the NASDAQ The NASDAQ now contains about 3, publicly traded companies, and is the second largest stock exchange in terms of its securities' values and the largest electronic stock market.

Trading on the NASDAQ Because it is an electronic exchange, the NASDAQ offers no trading floor. NASDAQ indexes Like any stock exchange, the NASDAQ uses an index, or a collection of stocks that are used to deliver a market performance snapshot.

History of the NASDAQ Founded by the National Association of Securities Dealers, the NASDAQ opened on Feb. Other notable dates on the NASDAQ timeline include: NASDAQ OMX NASDAQ Stock Market Library of Congress Business Reference Services.

Facebook Fans Can Impact Stock Prices. Small Businesses Make Stock Options a Preferred Employee Reward. Stock Advice in Characters or Less.

Start Your Business Business Ideas Business Plans Startup Basics Startup Funding Franchising Success Stories Entrepreneurs. Build Your Career Get the Job Get Ahead Office Life Work-Life Balance Home Office. Lead Your Team Leadership Women in Business Managing Strategy Personal Growth. Find A Solution HR Solutions Financial Solutions Marketing Solutions Security Solutions Retail Solutions SMB Solutions.