Accrued interest income cash basis taxpayer

Understanding whether a debt instrument includes qualified stated interest versus "paid-in-kind" PIK interest is critical in determining the deductibility and taxability of accrued interest not yet paid in cash or property. In addition, understanding when related-party rules may change the tax treatment of a debtor or creditor helps to ensure appropriate planning takes place to avoid unknown tax liabilities. When a creditor is a cash-basis taxpayer, the taxability of "accrued interest" depends on whether the interest is truly accrued but unpaid interest or, alternatively, PIK interest.

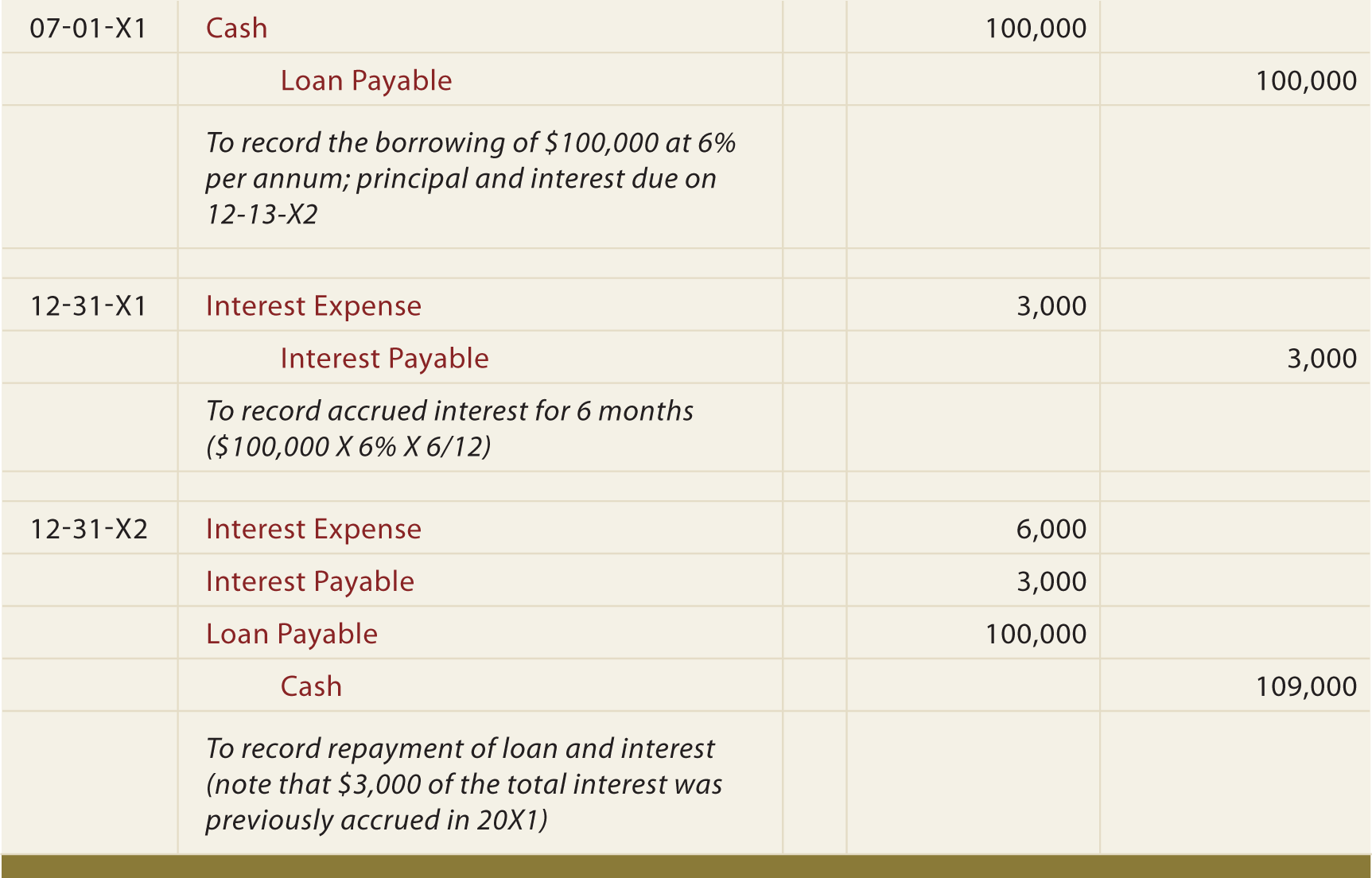

Where a debt instrument includes qualified stated interest QSI interest at a stated rate unconditionally payable in cash or property other than additional debt instruments of the debtor payable at least annually at a single fixed rate, such interest accrues during the debt instrument's accrual period e. Further, if the debtor is unable to make the QSI payments in cash or property, such interest will accrue as unpaid interest and will most likely be subject to a higher penalty interest rate.

In both instances, the cash-basis creditor is not required to recognize the accrued but unpaid interest in income due to the application of the cash method of accounting i.

Income Tax Folio - S3-F6-C1: Interest Deductibility

The answer for a cash-basis taxpayer changes significantly where the note calls for PIK interest. PIK interest accrues during the applicable accrual period and is then "paid in kind" through either the issuance of additional debt instruments or an increase in the principal of the existing debt. PIK interest is accounted for under the original issue discount OID rules for inclusion into income.

Under these rules, a creditor is required to report the appropriate PIK interest as income in the current year, regardless of its method of accounting. Therefore, a cash method creditor holding a PIK note is required to include current interest into income regardless of when it receives cash payment.

To some, this may come as an unwelcome surprise. The difference between PIK and accrued interest on QSI debts often occurs in the context of related parties.

For example, private equity PE firms often structure their investments in a portfolio with a mix of debt and equity, resulting in a situation where the PE firm owns in excess of 50 percent of the portfolio P and is also a creditor. Many PE investors and other non-tax professionals operate under a misconception that related-party rules serve to defer interest deductions on related-party debts until such interest is paid in cash. If not corrected early, this misconception can lead to unknown tax liabilities for debt holders.

Where P is an accrual-method taxpayer which will generally be the case with accrued and unpaid interest owed to PE an accrual-method fund , the failure to pay the interest does not absolve PE from including the interest in income. Rather, as an accrual-method taxpayer, PE should include the interest in income until PE claims and can support that the debt has become uncollectible. However, taking such a position must be considered carefully.

The result depends on whether PE enforced its creditor rights in significant enough a way to maintain the status of the interest as QSI unconditionally payable , as well as whether the failure to enforce creditor rights would cause a debt modification under Reg.

If PE is a cash-basis taxpayer and the interest is properly determined to be QSI, the accrued interest would not be taxable, and section would in fact defer the interest deduction by P until such interest is included in income by PE.

Section serves as a deferral mechanism where the deduction of one party is deferred until income is included by the other related party. With respect to PIK interest, the cash-basis debtor is required to include the interest in income currently to avoid a mismatching of current income and deduction between the debtor and creditor.

Unlike QSI, PIK interest is subject to the OID rules, meaning the deduction of interest expense or inclusion of interest income does not hinge on whether cash payments are made. RSM US LLP is a limited liability partnership and the U. The member firms of RSM International collaborate to provide services to global clients, but are separate and distinct legal entities that cannot obligate each other.

Each member firm is responsible only for its own acts and omissions, and not those of any other party. What We Offer What We Offer By Service By Service Audit Financial Reporting Resource Center Public Companies Employee Benefit Plan Audit Global Audit Service Organization Control Attestation. Resources Financial Reporting Insights Corporate Governance IFRS Resource Center COSO Resource Center.

International Tax Planning Federal Tax Private Client State and Local Tax Tax Function Optimization Washington National Tax Credits and Incentives. Resources Tax Alerts The Tax Exchange Tangible Property Regulations Affordable Care Act Tax Reform BEPS Resource Center.

RESOURCE CENTER Business Growth. Business Valuation Litigation and Dispute Advisory Forensic Accounting and Fraud Investigations IPO Readiness. Resources Our Key Professionals Capabilities. WHITE PAPER Three ways to identify and combat vendor fraud. Business Process Finance and Accounting Internal Audit Sarbanes-Oxley. Resources Risk Bulletin Technology Bulletin. WHITE PAPER Automating accounts payable and expense management.

Financial Institution Internal Audit Internal Audit Auditor Assistant: Resources Case Studies COSO Resource Center. RECORDED WEBCAST Cybersecurity and data breach preparedness webcast series. Management Consulting Cloud Portfolio Microsoft Solutions ERP and CRM Business Intelligence Infrastructure Managed IT Services Application Development and Integration Business Process Outsourcing Content Management. Mobility Intentional Growth and Sales Enablement Resources Emerging Technology Resource Center Emerging Technology Resource Center Rapid Assessment Technology Bulletin Case Studies Events Recognition.

WHITE PAPER Utilizing social CRM to enhance your business relationships. WHITE PAPER Issues in Negotiating Cash-Free Debt-Free Deals. How Do You See Your Money? Services We Offer What Makes Us Different People and Locations Value of Advice. Resources Weekly Market Commentary Monthly Market Commentary Monthly Economic Report Monthly Index Returns Quarterly Newsletter. VIDEO Value of advice: Understanding your entire financial picture. Retail Restaurant Food and Beverage Fashion and Home Furnishings.

Resources Consumer Products Insights Case Studies Events and Webcasts. RESOURCE CENTER RSM Omnichannel Survey. Mind the Tax Laws Global mobility issues in the energy industry.

Capabilities Specialty Finance Industry Advocacy Speakers Bureau. Resources Financial Institution Insights Compliance News. INSIGHT ARTICLE Audit Committee Guide for Financial Institutions. Brokerage and Trading Business Development Companies Hedge Funds Registered Investment Companies Small Business Investment Companies Insurance. Resources Investment Industry Insights Capabilities Key Professionals. INSIGHT ARTICLE RSM Hedge Fund Insights Federal State and Local.

WHITE PAPER GASB Statement No. Resources Capabilities Case Studies Events and Webcasts Strategic Partnerships.

INSIGHT ARTICLE Big issues facing the health care industry. Capabilities Contact our professionals. CASE STUDY Review recovers millions in royalties for life sciences company. VIDEO 5 trends in manufacturing to watch in Membership, Trade and Professional Organizations Charitable Organizations Cultural Organizations Religious Organizations Research and Scientific Organizations Foundations International Nonprofit Organizations.

VIDEO Nonprofit Technology Trends. Fund Transaction Advisory Portfolio.

Accrued interest vs PIK interest: Important distinctions | RSM US

Resources Case Studies Quarterly Industry Spotlights Private Equity Learning Exchange. INSIGHT ARTICLE Quarterly Industry Spotlights. More Industries Business and Professional Services Education Gaming Government Contracting Insurance Native American Private Clubs Specialty Finance.

Our Values History Leadership Board of Directors Our Offices Newsroom Experience RSM Celebrating 90 Years First-Choice Advisor Center Working With You Social Responsibility Diversity and Inclusion Ethics International RSM US Alliance The Gauntlet RSM Annual Report. Accrued interest vs PIK interest: Important distinctions exist for cash and accrual method taxpayers.

Related-party debts The difference between PIK and accrued interest on QSI debts often occurs in the context of related parties. Insight Unlike QSI, PIK interest is subject to the OID rules, meaning the deduction of interest expense or inclusion of interest income does not hinge on whether cash payments are made.

Share email linked in facebook twitter. Select your frequency Tax Alerts—when published Tax Alerts Roundup—every other week Both. Related Services Federal Tax Credits and Incentives. What is a reasonable premium?

- Income Tax Brackets

IRS to address conversion ratio adjustments for convertible debt REITs must be aware of the unique tax rules for hedging instruments. The Power of Being Understood Audit Tax Consulting. RSM US Links Contact Us Client Portals About Us Terms of Use Privacy Policy Sitemap. Global Services Audit Tax Consulting Financial Advisory Outsourcing Risk Advisory Technology and Management Consulting Transaction Advisory Wealth Management. Worldwide Locations Africa MENA Asia Pacific Europe Latin America North America.

Social Twitter LinkedIn YouTube Facebook. RSM US Client Portals MarketPrism. Terms of Use Privacy Contact Sitemap.