Interest rate derivatives trader linkedin

The professional energy community will gather in London for four days of cutting-edge discussions and networking with fellow industry peers at the 20th annual Energy Risk Summit Europe.

Structured Products runs three global awards programmes - for the Americas, Asia, and Europe - to celebrate excellence across the structured products markets. This white paper examines the interplay between the challenges and opportunities afforded by the growing breadth of digital channels offered by financial institutions. This white paper addresses organisational approaches to third party risk management and due diligence. Now in its eleventh year, the RiskTech is globally acknowledged as the most comprehensive independent study of the world's major players in risk and compliance technology.

This report updates the Chartis report Solvency II Technology Solutions , focussing on risk management systems for the insurance industry. Chartis is the leading provider of research and analysis on the global market for risk technology and is part of Incisive Media. Lourenco Miranda Buy now Landmarks in XVA: From Counterparty Risk to Funding Costs and Capital Dr.

A key supporting role to the CRO in enhancing and embedding risk information into operational and strategic decision making. We are exclusively recruiting for our client, a niche Investment Management firm with global offices, now looking for a Trainee Compliance Analyst You are currently accessing Risk. If you already have an account please use the link below to sign in.

If you have any problems with your access or would like to request an individual access account please contact our customer service team. In the fortnight leading up to the UK's referendum on membership of the European Union, the treasury unit at one big UK bank was trying to ensure it would not run out of US dollar funding.

Interest rate options trader linkedin

While opinion polls indicated a win for the Remain campaign, a win for Leave could see demand for dollars spike — from derivatives margin calls, for example — at the same time as a sterling crash. The bank was keen to give itself some flexibility by trading foreign exchange forwards and cross-currency swaps, but the cost for larger trades was soaring.

Enter Goldman Sachs' short-term macro group, created 18 months ago to trade foreign exchange forwards and short-term rates products. The group executed a series of forex forwards and cross-currency swaps with the UK bank in the two weeks leading up to the Brexit vote, when the risk premium in the market was at its greatest.

Goldman was able to provide what the UK bank saw as a fair price because it did not hedge the trades like-for-like, instead using a combination of short-term rates, cross-currency basis and forex trades to cover the market risk, leaving the US house with basis risk. If we see greater depth in the forwards market than the rates market, we may choose to hedge a client forward trade with a rates trade.

The 10 most desirable and lucrative jobs on offer at GS, JPM, BAML, MS and Citi right now

Warehousing this basis risk between the two markets allows us to offer the best liquidity to clients and minimise our execution footprint," says Beth Hammack, head of global repo and the global short-term macro business at Goldman Sachs in New York. A senior member of the UK bank's treasury team credits Goldman's proactive approach, willingness to provide capital — particularly for the cross-currency swaps — and the set-up of its short-term macro group for the success of the trades.

Goldman Sachs has long had a reputation as the dealer you go to when in a corner, and the events of look set to reinforce that. That stood out for clients. A New York-based senior derivatives trader at one of the world's biggest asset managers says: The differentiator is when things are moving around as in the post-Brexit or US election periods. We were able to move a lot of risk we needed to with them, more so than with others.

A US hedge fund manager also praises the bank for being willing to unwind trades during those periods of volatility: Some guys stepped back. These guys, instead of stepping back, stepped forward," he says. But some of these clients have detected a change in Goldman over the past 18 months. The standard knock against the bank in the past has been that it treats even its best customers as counterparties — providing second-to-none ideas, pricing and liquidity, but only when axed to do so.

This year, some of those clients say they are being treated more like customers, with Goldman placing more emphasis on consistency. The UK bank's treasury source, for example, says Goldman has made more of an effort to see the world through his eyes: It feels you're aligned with the way we look at the world, and you're willing to do things that a lot of other banks are not'. The New York-based senior derivatives trader says Goldman was always a major player, but has improved over the past two years, particularly in swaps and swaptions, where the dealer was top and top two for his employer, respectively, in There are liquidity constraints in the market, but they're very willing to work with us — if we disagree on where the market is, they're willing to meet in the middle.

They're taking a long-term view of specific trades and the relationship as well," says the derivatives trader.

Automated Trader Magazine | Strategies | Compliance | Technology

For Goldman, this is the culmination of a number of parallel initiatives over recent years. One effort was to try and improve its standing among real-money clients such as asset managers, insurers and pension funds — working with them not just on execution, but helping them understand and respond to wider market issues such as the inversion of the spread between US Treasuries and interest rate swaps, which was a big talking-point during the second half of Together with the creation of the short-term macro group, set up to combine instruments that are reliably correlated, it meant clients have become increasingly comfortable calling on the bank for a wider range of trades.

Goldman's traders claim to be seeing an increasing number of non-competitive block-size trades. Another beneficiary of this new approach has been the US government sponsored enterprises GSEs. A source at one of these says Goldman performs well in big swap trades, but also stands out in other areas — for example, helping benchmark the GSE's valuations, providing advice around the swap spread dislocation, and giving regular insight into regulatory or clearing-related matters.

Another change can be seen in the treatment of non-core units at other banks, which were previously considered competitors, but are now seen as clients that should be served like any other large, sophisticated firm. This change saw Goldman Sachs bidding to conduct significant compression and backloading exercises with a number of non-core bank clients.

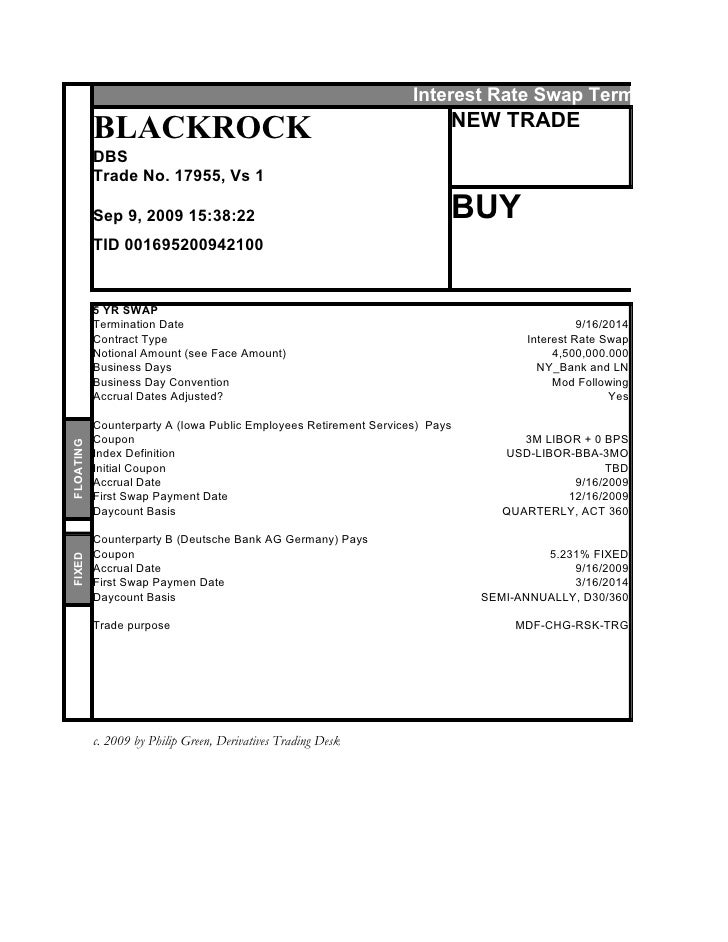

In one exercise, Goldman and a European bank wanted to backload bilateral swaps in a single currency to LCH, but hit a problem. First, the backloading would subject the parties to larger initial margin payments at the clearing house. Second, the change would have a negative impact on Goldman Sachs' US stress test results, due to a specific scenario the bank had to model.

To resolve both issues, Goldman suggested bringing other currencies and products into the process. Goldman Sachs also bought "a handful" of multi-line item exotic interest rate derivatives portfolios in from banks that were either looking to cut their exotics footprint, or their capital requirements.

Like many dealers, Goldman Sachs has been investing in new data analytics in an attempt to make its salespeople more effective — giving teams information on hit ratios and enquiries, as well as a salesperson's performance across products and sectors. To crunch the numbers quickly, the bank has stored the data on the Apache Hadoop framework, where data files are split into large blocks and distributed across nodes.

Programming code is then passed through the nodes to process the data in parallel with other nodes, improving efficiency. But while data processing speed is important, the crucial thing was making the system accessible for salespeople to use it. Now, key salespeople are able to parse the data themselves, allowing them to check client needs and their own performance more regularly, but also to provide feedback on how the business should be slicing the data.

Now salespeople have QlikView dashboards where it's very easy to pivot the data themselves in real-time," says Madoff.

Events Awards White papers Research Books Jobs Newsletters Welcome My account Sign in. Energy Risk Europe The professional energy community will gather in London for four days of cutting-edge discussions and networking with fellow industry peers at the 20th annual Energy Risk Summit Europe. Structured Products Awards Asia Structured Products Awards Asia 05 Sep Date TBC - Hong Kong, Hong Kong.

Structured Products Awards Europe Structured Products runs three global awards programmes - for the Americas, Asia, and Europe - to celebrate excellence across the structured products markets.

Digital Channel Threat Report - Derisking Convenience This white paper examines the interplay between the challenges and opportunities afforded by the growing breadth of digital channels offered by financial institutions. Risk Management Systems for the Insurance Industry - Market Update This report updates the Chartis report Solvency II Technology Solutions , focussing on risk management systems for the insurance industry. Capital Planning and Stress Testing under CCAR Lourenco Miranda Buy now.

Chris Kenyon and Dr Andrew Green Buy now. Find the latest jobs. Search by job title, salary or location to find your perfect role.

Don't miss out on new jobs Sign up. Job of the week.

Interest rate derivatives house of the year: Goldman Sachs - eqogypacuc.web.fc2.com

Interest rate derivatives house of the year: Goldman Sachs Risk Awards New macro group proves worth in Brexit and US election drama. The New York team: Toh NeWin, Paula Madoff, Beth Hammack and Scott Rofey. Risk interdealer broker rankings - VOTE NOW 20 Jun Law firm of the year: Davis Polk 02 Jun North America house of the year: JP Morgan 02 Jun Institutional structurer of the year: Barclays 02 Jun Technology provider of the year vendor ; Pricing and analytics platform of the year: Numerix 02 Jun Latin America house of the year: BBVA 02 Jun Index provider of the year: Deal of the year: Trump reforms, euro clearing and FRTB The week on Risk.

Most read on Risk. University of Bologna Numbers game: Mifid guidance adds to swaps trading confusion. You must be signed in to use this feature Sign in. Contact us Advertising About Incisive Media Terms and conditions Privacy and cookie policy RSS.