Foreign exchange rate systems

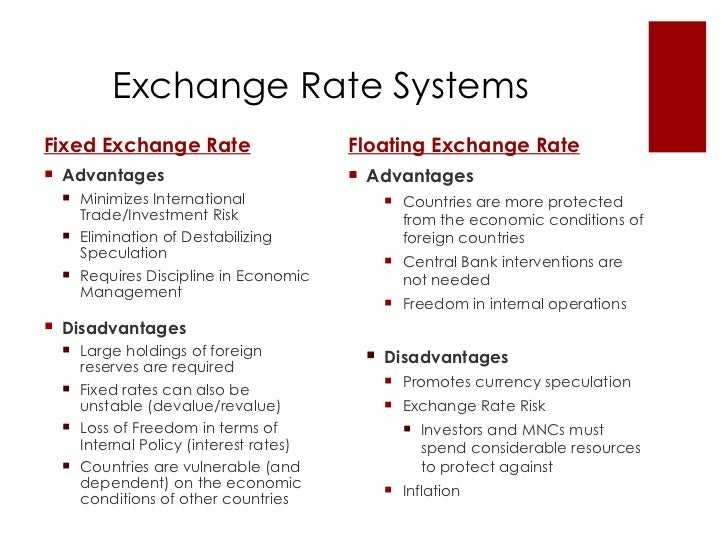

The three major types of exchange rate systems are the float, the fixed rate, and the pegged float. A currency system that fixes an exchange rate around a certain value, but still allows fluctuations, usually within certain values, to occur.

A system where a currency's value is tied to the value of another single currency, to a basket of other currencies, or to another measure of value, such as gold. A system where the value of currency in relation to others is allowed to freely fluctuate subject to market forces.

The way in which an authority manages its currency in relation to other currencies and the foreign exchange market. One of the key economic decisions a nation must make is how it will value its currency in comparison to other currencies.

An exchange rate regime is how a nation manages its currency in the foreign exchange market. An exchange rate regime is closely related to that country's monetary policy. There are three basic types of exchange regimes: The above map shows which countries have adopted which exchange rate regime. Dark green is for free float, neon green is for managed float, blue is for currency peg, and red is for countries that use another country's currency. A floating exchange rate, or fluctuating exchange rate, is a type of exchange rate regime wherein a currency's value is allowed to fluctuate according to the foreign exchange market.

A currency that uses a floating exchange rate is known as a floating currency. The dollar is an example of a floating currency. Many economists believe floating exchange rates are the best possible exchange rate regime because these regimes automatically adjust to economic circumstances. These regimes enable a country to dampen the impact of shocks and foreign business cycles , and to preempt the possibility of having a balance of payments crisis.

However, they also engender unpredictability as the result of their dynamism. A fixed exchange rate system, or pegged exchange rate system, is a currency system in which governments try to maintain a currency value that is constant against a specific currency or good.

In a fixed exchange-rate system, a country's government decides the worth of its currency in terms of either a fixed weight of an asset , another currency, or a basket of other currencies. The central bank of a country remains committed at all times to buy and sell its currency at a fixed price.

To ensure that a currency will maintain its "pegged" value, the country's central bank maintain reserves of foreign currencies and gold.

They can sell these reserves in order to intervene in the foreign exchange market to make up excess demand or take up excess supply of the country's currency. The most famous fixed rate system is the gold standard , where a unit of currency is pegged to a specific measure of gold. Regimes also peg to other currencies. These countries can either choose a single currency to peg to, or a "basket" consisting of the currencies of the country's major trading partners. Pegged floating currencies are pegged to some band or value, which is either fixed or periodically adjusted.

These are a hybrid of fixed and floating regimes.

There are three types of pegged float regimes:. Boundless vets and curates high-quality, openly licensed content from around the Internet. This particular resource used the following sources:. Except where noted, content and user contributions on this site are licensed under CC BY-SA 4. Read Feedback Version History Usage.

Fixed vs. Pegged Exchange Rate Systems

Learning Objective Differentiate common exchange rate systems. Key Points A floating exchange rate or fluctuating exchange rate is a type of exchange rate regime wherein a currency 's value is allowed to freely fluctuate according to the foreign exchange market.

A fixed exchange-rate system also known as pegged exchange rate system is a currency system in which governments try to maintain their currency value constant against a specific currency or good. Pegged floating currencies are pegged to some band or value, either fixed or periodically adjusted.

Example Examples of floating currencies include the US dollar, the European Union euro, the Japanese yen, and the British pound. Examples of fixed currencies include the Hong Kong dollar, the Danish krone, and the Bermudian dollar. Foreign Exchange Regimes The above map shows which countries have adopted which exchange rate regime.

Prev Concept Exchange Rate Policy Choices. Create Question Referenced in 1 quiz question A country allows its currency to freely fluctuate according to the foreign exchange market. What type of exchange regime does this country have?

Best Foreign Exchange Rates - TorFX

Key Term Reference Union Appears in these related concepts: The Wage Rate , Growth of Government Intervention , and Continuity and Change. Goodwill Impairment , Shifts in the Money Demand Curve , and Balance Sheets. Balance of Payments , The Balance of Payments , and Finding an Equilibrium Exchange Rate.

Job Creation and Destruction , Effect of a Government Budget Deficit on Investment and Equilibrium , and Days Sales Outstanding. The Creation of the Federal Reserve , The Money Multiplier in Theory , and Arguments For and Against Inflation Targeting Policy Interventions.

Maintaining a Strong Economy , Non-Bank Financial Institutions , and Measuring the Money Supply. Addressing Market Needs , Definition of Price Elasticity of Supply , and Applications of Elasticities.

Fixed exchange-rate system - Wikipedia

Bernanke Era and Defining Capital. Reporting Assets , Sale , and Sample Income Statement.

Exchange-rate regime - Wikipedia

Triple Integrals in Cylindrical Coordinates , Thermal Stresses , and Compensation Differentials. Exchange Rates , International Exchange of Money , and Introducing Exchange Rates. The Importance of Aggregate Decisions about Consumption versus Saving and Investment , Reason for a Zero Balance , and Exchange Rate Policy Choices.

The Nixon Shock , Economic Conditions , and Monetarist. Greenspan Era , The Financial Account , and Determinants of investment. Introducing Externalities , Antitrust Laws , and Introduction to the Role of the Government in the Economy.

Keynesian Theory , The Reserve Ratio , and Trends in Credit After Break-Even Analysis , Terms Used to Describe Price , and Defining a Market System. The Federal Open Market Committee and the Role of the Fed , The Federal Funds Rate , and Government's Role in the Economy. The Fractional Reserve System , The Effect of Restrictive Monetary Policy , and The Federal Reserve and the Financial Crisis of Homeostatic Responses to Shock , Types of Shock , and Shifts in investment due to shocks.

Impacts of Supply and Demand on Businesses , The Slope of the Short-Run Aggregate Supply Curve , and Macroeconomic Equilibrium. Sources Boundless vets and curates high-quality, openly licensed content from around the Internet.

This particular resource used the following sources: Subjects Accounting Algebra Art History Biology Business Calculus Chemistry Communications Economics Finance Management Marketing Microbiology Physics Physiology Political Science Psychology Sociology Statistics U. History World History Writing. Products For Students For Educators For Institutions Quizzes Integrations.

Boundless About Us Approach Partners Press Community Accessibility. Follow Us Facebook Twitter Blog. Visit Support Email Us. Legal Terms of Service Privacy.