Warrant stock market

In finance , a warrant is a security that entitles the holder to buy the underlying stock of the issuing company at a fixed price called exercise price until the expiry date.

Warrants and options are similar in that the two contractual financial instruments allow the holder special rights to buy securities.

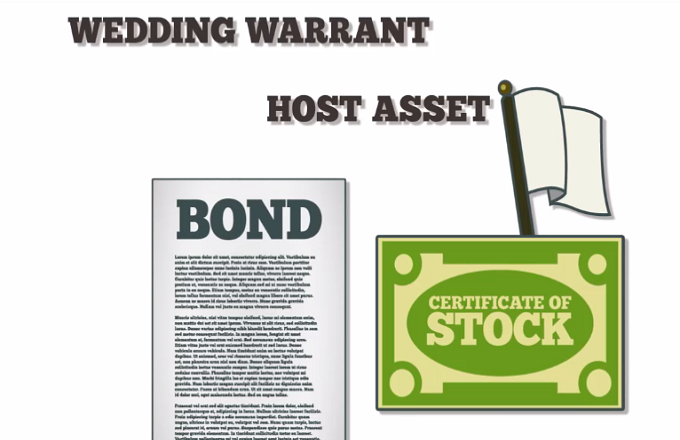

Both are discretionary and have expiration dates. The word warrant simply means to "endow with the right", which is only slightly different from the meaning of option. Warrants are frequently attached to bonds or preferred stock as a sweetener, allowing the issuer to pay lower interest rates or dividends. They can be used to enhance the yield of the bond and make them more attractive to potential buyers. Warrants can also be used in private equity deals.

Frequently, these warrants are detachable and can be sold independently of the bond or stock. In the case of warrants issued with preferred stocks, stockholders may need to detach and sell the warrant before they can receive dividend payments. Thus, it is sometimes beneficial to detach and sell a warrant as soon as possible so the investor can earn dividends.

Warrants have similar characteristics to that of other equity derivatives, such as options, for instance:. The warrant parameters, such as exercise price, are fixed shortly after the issue of the bond.

With warrants, it is important to consider the following main characteristics:. Warrants are longer-dated options and are generally traded over-the-counter. Sometimes the issuer will try to establish a market for the warrant and to register it with a listed exchange. In this case, the price can be obtained from a stockbroker.

But often, warrants are privately held or not registered, which makes their prices less obvious. Unregistered warrant transactions can still be facilitated between accredited parties and in fact several secondary markets have been formed to provide liquidity for these investments. Warrants are very similar to call options. For instance, many warrants confer the same rights as equity options and warrants often can be traded in secondary markets like options.

However, there also are several key differences between warrants and equity options:. There are various methods models of evaluation available to value warrants theoretically, including the Black-Scholes evaluation model. However, it is important to have some understanding of the various influences on warrant prices. The market value of a warrant can be divided into two components:. There are certain risks involved in trading warrants—including time decay. A wide range of warrants and warrant types are available.

The reasons you might invest in one type of warrant may be different from the reasons you might invest in another type of warrant. Traditional warrants are issued in conjunction with a bond known as a warrant-linked bond and represent the right to acquire shares in the entity issuing the bond. In other words, the writer of a traditional warrant is also the issuer of the underlying instrument. Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce the interest rate that must be offered in order to sell the bond issue.

Naked warrants are issued without an accompanying bond and, like traditional warrants, are traded on the stock exchange.

They are typically issued by banks and securities firms. These are also called covered warrants and are settled for cash, e.

In most markets around the world, covered warrants are more popular than the traditional warrants described above.

Financially they are also similar to call options, but are typically bought by retail investors, rather than investment funds or banks, who prefer the more keenly priced options which tend to trade on a different market.

Covered warrants normally trade alongside equities, which makes them easier for retail investors to buy and sell them. Third-party warrant is a derivative issued by the holders of the underlying instrument. This warrant is company-issued. These are called third-party warrants. The primary advantage is that the instrument helps in the price discovery process. If volumes in such warrants are high, the price discovery process will be that much better; for it would mean that many investors believe that the stock will trade at that level in one year.

Third-party warrants are essentially long-term call options. The seller of the warrants does a covered call-write. That is, the seller will hold the stock and sell warrants against them. The seller will, therefore, keep the warrant premium. From Wikipedia, the free encyclopedia. This article is about a financial instrument. For the payment method, see warrant of payment. Banknote Bond Debenture Derivative Stock. Stock market Commodity market Foreign exchange market Futures exchange Over-the-counter market OTC Spot market.

Fixed rate bond Floating rate note Inflation-indexed bond Perpetual bond Zero-coupon bond Commercial paper. Corporate bond Government bond Municipal bond Pfandbrief. Stock Share Initial public offering IPO Short selling. Mutual fund Closed-end fund Exchange-traded fund ETF Hedge fund Index fund Segregated fund.

Securitization Agency security Asset-backed security Mortgage-backed security Commercial mortgage-backed security Residential mortgage-backed security Tranche Collateralized debt obligation Collateralized fund obligation Collateralized mortgage obligation Credit-linked note Unsecured debt.

Forward Futures Option Swap Warrant Credit derivative Hybrid security. Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Risk-free interest rate Strike price the Greeks Volatility. Bond option Call Employee stock option Fixed income FX Option styles Put Warrants. Asian Barrier Basket Binary Chooser Cliquet Commodore Compound Forward start Interest rate Lookback Mountain range Rainbow Swaption.

Collar Covered call Fence Iron butterfly Iron condor Straddle Strangle Protective put Risk reversal. Back Bear Box Bull Butterfly Calendar Diagonal Intermarket Ratio Vertical. Binomial Black Black—Scholes model Finite difference Garman-Kohlhagen Margrabe's formula Put—call parity Simulation Real options valuation Trinomial Vanna—Volga pricing.

Amortising Asset Basis Conditional variance Constant maturity Correlation Credit default Currency Dividend Equity Forex Inflation Interest rate Overnight indexed Total return Variance Volatility Year-on-Year Inflation-Indexed Zero-Coupon Inflation-Indexed. Contango Currency future Dividend future Forward market Forward price Forwards pricing Forward rate Futures pricing Interest rate future Margin Normal backwardation Single-stock futures Slippage Stock market index future.

Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Collateralized debt obligation CDO Constant proportion portfolio insurance Contract for difference Credit-linked note CLN Credit default option Credit derivative Equity-linked note ELN Equity derivative Foreign exchange derivative Fund derivative Interest rate derivative Mortgage-backed security Power reverse dual-currency note PRDC.

Consumer debt Corporate debt Government debt Great Recession Municipal debt Tax policy. Retrieved from " https: Corporate finance Equity securities Options finance.

Self-contradictory articles from February All self-contradictory articles Articles needing cleanup from June All pages needing cleanup Cleanup tagged articles without a reason field from June Wikipedia pages needing cleanup from June Pages using ISBN magic links. Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Warrant (finance) - Wikipedia

Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. This page was last edited on 7 April , at Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view.

Securities Banknote Bond Debenture Derivative Stock. Markets Stock market Commodity market Foreign exchange market Futures exchange Over-the-counter market OTC Spot market.

Bonds by coupon Fixed rate bond Floating rate note Inflation-indexed bond Perpetual bond Zero-coupon bond Commercial paper. Bonds by issuer Corporate bond Government bond Municipal bond Pfandbrief. Equities stocks Stock Share Initial public offering IPO Short selling.

What is Warrant?Investment funds Mutual fund Closed-end fund Exchange-traded fund ETF Hedge fund Index fund Segregated fund. Structured finance Securitization Agency security Asset-backed security Mortgage-backed security Commercial mortgage-backed security Residential mortgage-backed security Tranche Collateralized debt obligation Collateralized fund obligation Collateralized mortgage obligation Credit-linked note Unsecured debt.

Derivatives Forward Futures Option Swap Warrant Credit derivative Hybrid security. Please see the talk page for more information. This section may require cleanup to meet Wikipedia's quality standards.

Live BSE, NSE, Stock Prices, Expert Stock Advice, Share Market Updates : eqogypacuc.web.fc2.com

No cleanup reason has been specified. Please help improve this section if you can. June Learn how and when to remove this template message. Terms Credit spread Debit spread Exercise Expiration Moneyness Open interest Pin risk Risk-free interest rate Strike price the Greeks Volatility.