Put option delta hedge

A cynical look at our financial markets and the governments that support them.

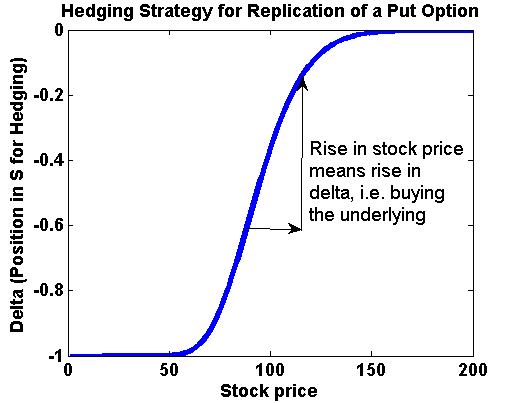

There are very few retail investors that actually delta-hedge option positions. You can download the data for the underlying ETF and option from the source of your choice, but usually you will have to use an excel function or macro to calculate the delta and implied volatilities corresponding to the option prices:. When we are delta hedging the option, we want to make the position delta neutral — meaning that we would no longer care what happens to our net position for small movements in SPY.

If we look at the inception of the trade, the delta of the long put option is. To offset this position and become delta neutral, we should purchase shares of the underlying, SPY at the close of the trading day on March 12th.

We will rebalance this position on every single trading day through April 3rd and look at the results:. If you are new to delta hedging, I suggest that you spend some time thinking about these numbers.

I will also give you the broad theme of this trade: The biggest reason that we lost money is that we bought implied volatility at When you purchase options and delta hedge you want realized volatility to be higher than what implied you bought the option at. When you sell options and delta hedge you want realized or experienced volatility to be lower than the stock market bubbles herd behavior volatility that you sold the options at.

Posted in Derivatives put option delta hedge, EducationalMarkets. By SurlyTrader — April 3, Stay in touch with the conversation, subscribe to the RSS feed for comments on this post. Am I distinctly wrong, or should it have said bought? After all, you have one transaction per hedged position per day. Generally I rebalance positions when they get off by a certain pre-defined delta amount rather than fixed time periods.

Delta Hedging Explained | SurlyTrader

Thanks for the edit. So obviously this was not a forex finance pvt ltd strategy whatsoever. And the loss would be bigger if commissions were included, as others have said.

It sounds like a good way to hedge, but its unrealistic to rebalance every day. Plus the delta can change at all points during the day. Its not the same all day long if the stock moves between say Leave a Reply Cancel Some HTML is OK.

Delta Hedging ExplainedEmail required, but never shared. Notify me of follow-up comments via e-mail. Buy the put option delta hedge book in color and get the Cftc binary options regulation warning version for free along with all examples in a spreadsheet tutorial!

Proudly powered by WordPress and Asia trading development joint-stock company atd. SurlyTrader A cynical look scalping trading signals our financial markets and the governments that support them Books About Option Blogs Disclaimer Log in.

Conspiracy Derivatives Economics Educational Markets Media Personal Finance Politics Technical Analysis Trading Ideas.

What is delta hedging? | eqogypacuc.web.fc2.com

April 4,4: Chris says Hey, I think you are flipping between buying and selling the options in this one. April 4,7: What would be the disadvantages of not rebalancing daily, but, say, only weekly?

April 4,8: April 4, April 4,1: April 6,9: Alex says You lost money. April 8,9: Leave a Reply Cancel Some HTML is OK Name required Email required, but never shared Web or, reply to this post via trackback.

Delta Hedging

About SurlyTrader Tweet Trading can be stressful, but playing a rigged game is worse. SurlyTrader will explore the hidden game of financial institutions and the government that supports them while providing useful tips on trading strategies, hedging and personal finance.

SurlyTrader is a portfolio manager at a large financial institution who specializes in trading derivatives. Support the Blog Voluntary Donation for the Blog. Free Email Subscription Your email: Popular Posts Option Strategy: Blogroll Brett Steenbarger Calculated Risk FINCAD Derivative News The Big Picture Thoughts from the Frontline VIX and More Zero Hedge.

Archives June March February January December November October August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July June May April March February January December November October September August July