Matlab european call option

Translated by Mouseover text to see original. Click the button below to return to the English verison of the page. This page has been translated by MathWorks. Please click here To view all translated materals including this page, select Japan from the country navigator on the bottom of this page. The automated translation of this page is provided by a general purpose third party translator tool.

MathWorks does not warrant, and disclaims all liability for, the accuracy, suitability, or fitness for purpose of the translation. Any input argument can be a scalar, vector, or matrix.

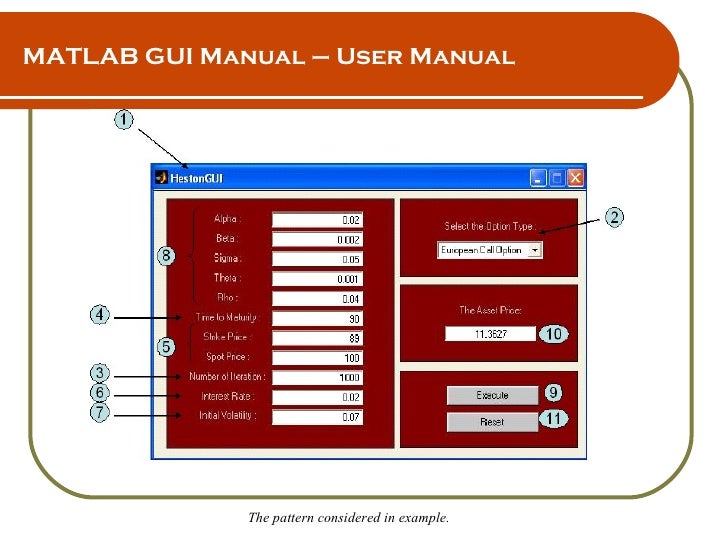

If a scalar, then that value is used to price all options. If more than one input is a vector or matrix, then the dimensions of those non-scalar inputs must be the same. Ensure that Rate , Time , Volatility , and Yield are expressed in consistent units of time.

Calculate the value of a three-month European call and put with a strike price of Annualized continuously compounded risk-free rate of return over the life of the option, specified as a positive decimal number. Annualized asset price volatility that is, annualized standard deviation of the continuously compounded asset return , specified as a positive decimal number.

Option Pricing using Finite Difference MethodOptional Annualized continuously compounded yield of the underlying asset over the life of the option, specified as a decimal number. If Yield is empty or missing, the default value is 0. For example, Yield could represent the dividend yield annual dividend rate expressed as a percentage of the price of the security or foreign risk-free interest rate for options written on stock indices and currencies. When pricing Futures Black model , enter the input argument Yield as: Options, Futures, and Other Derivatives.

Oxford University Press, Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands. Choose your country to get translated content where available and see local events and offers.

Based on your location, we recommend that you select: Contacts Comment acheter Se connecter.

Documentation Home Financial Toolbox Examples Functions and Other Reference Release Notes PDF Documentation.

This is machine translation Translated by. Select Language Bulgarian Catalan Chinese Simplified Chinese Traditional Czech Danish Dutch English Estonian Finnish French German Greek Haitian Creole Hindi Hmong Daw Hungarian Indonesian Italian Japanese Korean Latvian Lithuanian Malay Maltese Norwegian Polish Portuguese Romanian Russian Slovak Slovenian Spanish Swedish Thai Turkish Ukrainian Vietnamese Welsh. Examples collapse all Compute European Put and Call Option Prices Using a Black-Scholes Model.

Walking Randomly » European Option Pricing in Julia and MATLAB

Compute European Put and Call Option Prices on a Stock Index Using a Black-Scholes Model. Price a European Call Option with the Garman-Kohlhagen Model. Input Arguments collapse all Price — Current price of underlying asset numeric. Current price of the underlying asset, specified as a numeric value. Strike — Exercise price of the option numeric. Exercise price of the option, specified as a numeric value.

Rate — Annualized continuously compounded risk-free rate of return over life of the option positive decimal.

Time — Time to expiration of option numeric. Time to expiration of the option, specified as the number of years.

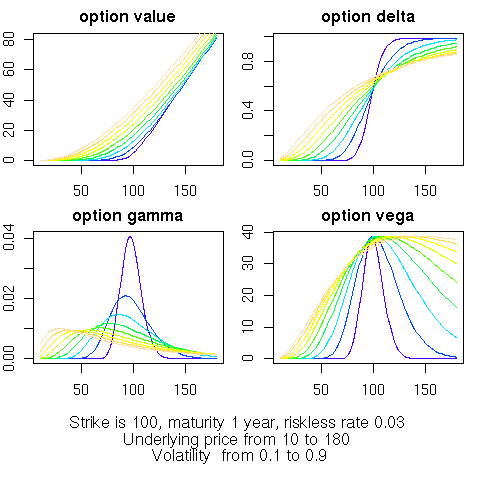

Volatility — Annualized asset price volatility positive decimal. Yield — Annualized continuously compounded yield of underlying asset over life of the option 0 default decimal. Output Arguments collapse all Call — Price of a European call option matrix. Price of a European call option, returned as a matrix. Put — Price of a European put option matrix. Price of a European put option, returned as a matrix.

References Hull, John C. See Also blkprice blsdelta blsgamma blsimpv blsprice blsrho blstheta blsvega Topics Pricing and Analyzing Equity Derivatives Greek-Neutral Portfolios of European Stock Options Plotting Sensitivities of an Option Plotting Sensitivities of a Portfolio of Options. You clicked a link that corresponds to this MATLAB command: Was this topic helpful?

VBA6 - Black-Scholes Option Pricing Model

Select Your Country Choose your country to get translated content where available and see local events and offers. Americas Canada English United States English. Financial Toolbox Documentation Examples Functions and Other Reference Release Notes PDF Documentation. Other Documentation MATLAB Financial Instruments Toolbox Econometrics Toolbox Statistics and Machine Learning Toolbox Risk Management Toolbox Documentation Home.

Support MATLAB Answers Installation Help Bug Reports Product Requirements Software Downloads.