Bank nifty options lot size

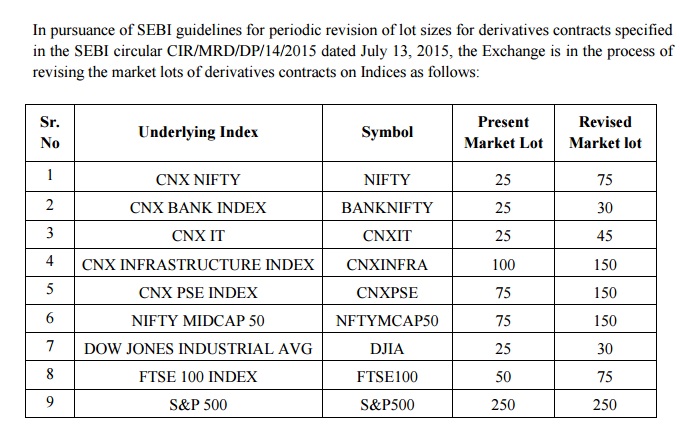

Recently NSE released a circular stating a change in the lot sizes. Kindly go through the following email to keep yourself updated with the changes and the steps to be taken. The lot size of NIFTY, BANK NIFTY and some Futures stocks will be revised as per the NSE Circulars dated August 07, and August 14, In case any position remains open with a lot size of less than 75 December expiry onwards then the trading system will not allow you to square this position off till the expiry.

This is because contracts with a lot size of less than 75 will not be available in the market. It will be squared off by the exchange on the respective expiry date.

Stock/Share Market Investing - Live BSE/NSE, India Stock Market Recommendations and Tips, Live Stock Markets, Sensex/Nifty, Commodity Market, Investment Portfolio, Financial News, Mutual Funds

The lot size for several stocks and indices has changed. This email contains only the most critical updates. Nifty future contracts with a maturity of September and October will continue to have the existing lot size of 25 quantities and contacts with a maturity in November onwards will have a lot size of 75 quantities.

The lot size of all subsequent contracts having expiry greater than 3 months and including December contracts shall be revised from 50 to 75 after the expiry of September contracts i. Here is an example! If you have an open position of quantities in Nifty option December expiry, even after September 24, , you will only be able to square off 75 quantities.

The remaining 25 Qty will remain open and you will not be able to place the square off order for the same. It will be squared off by the exchange on the last day of December expiry. Same will be applicable for contracts having expiry greater than 3 months.

We hope this email has helped you understand the changes properly. If not so please feel free to leave your concerns in the comments below and we will make sure we get back to you with the best possible solution. Also Read overbought stocks: How to identify and take advantage. Subscribe now to get latest updates! September 30, at 5: Very clear conceptions you have and I must congratulate you on your writing style.

I will surely bookmark this blog for future updates.

I once read in a book on the stock market about options and futures, Could you specify what they are? Change in Lot Size for Nifty, Bank Nifty and NSE Securities By Trade Smart Online September 23, Trading 2 Comments.

What is Bank Nifty index and Bank nifty futuresWhat was the official communication? What must I keep in mind? The spread order book will not be available for the combination contract of September — November and October — November expires. All open contracts of Nifty options would be retained as a multiple of 75 quantities with effect from September 28, December expiry onwards.

So if the total quantities of your open positions are not a multiple of 75, we advise that you square off all the residual quantities on or before the 24th of Sep, trading session ends.

We advise that you square off these 50 quantities on or before the 24th of Sept. What exactly has changed? For Nifty Future contracts Nifty future contracts with a maturity of September and October will continue to have the existing lot size of 25 quantities and contacts with a maturity in November onwards will have a lot size of 75 quantities. For Nifty Options Contracts The lot size of all subsequent contracts having expiry greater than 3 months and including December contracts shall be revised from 50 to 75 after the expiry of September contracts i.

I am confused, can you give me an example? How to identify and take advantage Subscribe now to get latest updates! Nifty BeES Trade Smart Online Blog says: March 31, at 7: Leave a Reply Cancel reply. Recent Posts Are cars a good Investment? Comparison between Technical and Fundamental Analysis 10 ways in which how not to lose money in stock markets How to make money in the Indian stock market? Archives Archives Select Month June May April March February January December November October September July May April March February November October September August July June May April March February January December November October September August July June May April March February January November October September August July June May April March February January REQUEST FOR BLOG Request for the blog topic giving information on it's origins as well as.

AbOUT US Who we are Management Why us Refer and Earn Career. TRADING Trading Platform Fund Transfer Our Services Calculators EquiMax.

Live Options | Nifty Options | Live Option Charts

HELP Knowledgebase Request support ticket Downloads Contact Us Blog. Investor Grievance NSE Investor Grievance BSE Investor Grievance MCX Investor Grievance NCDEX Privacy Policy Disclaimer Management Policy and Procedure Related links: NSE BSE MCX NCDEX RBI CDSL SEBI.

INB INF INE INE INB INF CDSL Reg No: Send to Email Address Your Name Your Email Address document. Sorry, your blog cannot share posts by email.