Puts on the stock market crash of 1929 canada

The roaring 20's had created a landscape where not only the rich were investing in the stock market but people from every walk of life and almost all economic classes began to put money into the markets. These margin calls were rarely made until the fall of The market had been raising all through the 20's and as it climbed higher and higher, more and more invested a piece of their savings or in some cases all of their money into the market.

Some even mortgaged their houses to get money to invest,. Stories abounded of the great profits to be made, the easy money that was generated on the markets and the lifestyle which became possible as a result of the profits on investment. This was not the first bubble of its kind. By August - September the Dow Jones Industrial Average, in the U.

The Great Crash - The Canadian Encyclopedia

By early September two Canadian stocks, Imperial and BA reached record highs. On September 6th a wave of selling hit the markets and then buying kicked in. For the remainder of the month the market began to swing between selling and buying in increasingly chaotic patterns. By the beginning of October an anxiety had crept into the markets and on October 4th Bay Street and Wall Street were hit with tidal wave of selling.

The Toronto Stock Exchange recorded about million in loses on the day. The following day buyers rushed in to pick up what they thought were bargains and prices began to rise again. By October 17th a rally seemed to be underway and the Financial Post had predicted that Canadian Mining Stocks would be the blue chip buy of the 's. By the afternoon a heavy wave of selling had again invaded the market and driven it down sharply.

A few days later in New York on October 21st the same type of selling trend set in. Both markets seemed to recover and be on their way up again on October 22nd but there was nervousness in the market.

By the 23rd the tension in the markets was reaching a breaking point and many investors were completely confused as to the future of the market. The morning of October 24th or what would become known as Black Thursday, began with many brokers making margin calls for more money to cover their positions.

More and more of their calls were unanswered and the brokers began to dump sell orders into the market in order to protect themselves. Their prudent actions turned into fear of selling to late and the market slide began to accelerate.

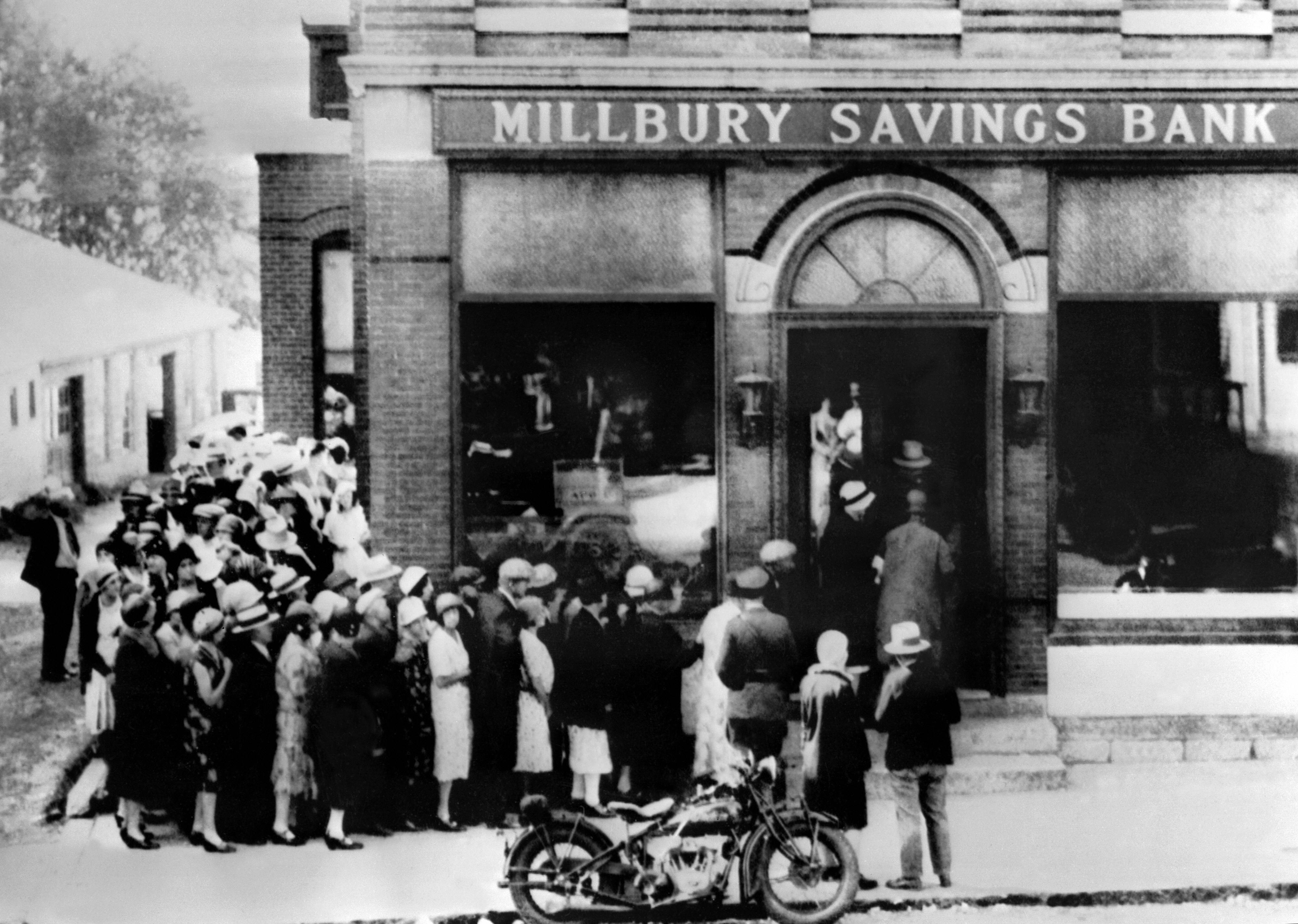

Stock Market Crash of 1929The fear turned into panic and sock prices started to collapse completely. Crowds had begun to gather outside the Toronto Stock Exchange, The New York Exchange, Chicago, Winnipeg, Montreal. Order broke down, police were called in and the markets kept following.

Ticker Tapes fell hopeless behind the action with exchanges losing touch with each other due to the volume of activity. Montreal which had average about 25, shares traded a day jumped to over , shares and New York traded over 13 million shares. The bankers, brokers and politicians all stepped forward claiming that the slide in the market was a glitch and that the fundamentals of the economy were sound.

They helped steady the market on Friday but over the weekend many investors had a chance to think about their positions and on Monday the slide began again as the sell orders once again flooded in.

Wall Street Crash of - Wikipedia

The Toronto Stock Exchange slide by one million dollars a minute and by the close of trading on Monday, the brokers had sent out margin call notices to almost all of their clients in an effort to stem the selling. Tuesday morning opened with another huge drop and the worst day of the crash, October 29th, or Black Tuesday had begun.

As the markets went into free fall, investors, brokers and the public watched the drama unfold. Some became hysterical, some began to cry softly, and some just watched in silence.

Crash

Terror crept into every investors mind as the market dropped straight down. The golden promise of the roaring 20's was shattered in a day as was the financial stability of the nation.

Stocks were sold at any price offered as complete confusion overtook the trading process. The catastrophe hit anyone who had invested in the markets. Bennett the next Prime Minister also lost a fortune but could afford the loss. Some of the declines on the Toronto Stock Exchange were Brazilian Traction 82 to 12, BA Oil 36 to 8, Cockshutt 53 to 4 and Winnipeg Electric to The Canadian bluechip stocks lost over 5 billion dollars in value which in exceeds anything before or since.

The spirit of the investor was broken and the markets and the financial systems lie in ruins. Canada History Your browser does not support inline frames or is currently configured not to display inline frames.